inheritance tax changes 2021 uk

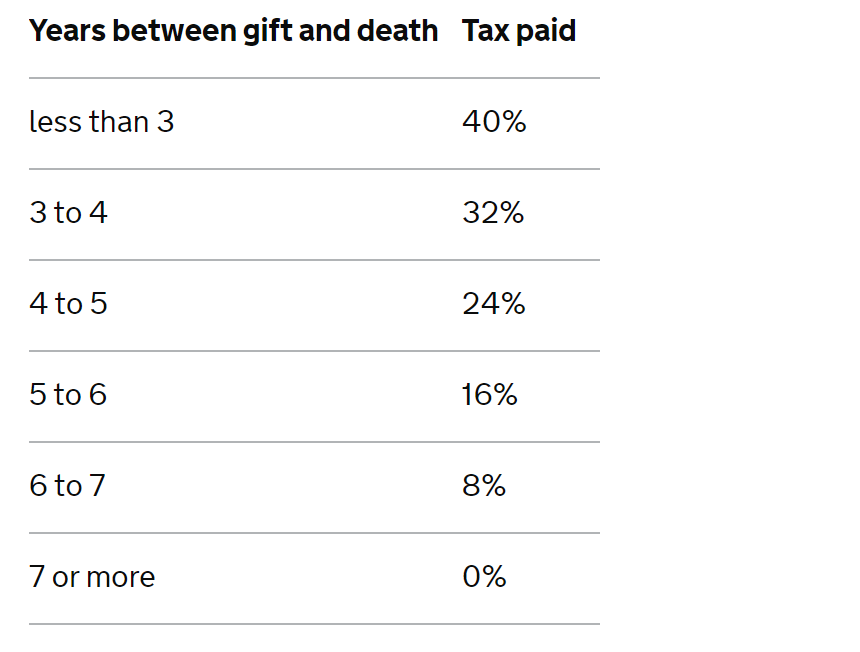

Section 8D 5 of the IHTA outlines the taper threshold which. Gifts and other transfers of value IHT403 1 June 2020.

Budget 2021 Inheritance And Capital Gains Tax Breaks Frozen To 2026 Which News

Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs.

. In the tax year 2019 to 2020 376 of UK deaths resulted in an Inheritance Tax IHT charge increasing slightly by 002 percentage points. Ad Inheritance and Estate Planning Guidance With Simple Pricing. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor. Learn How EY Can Help.

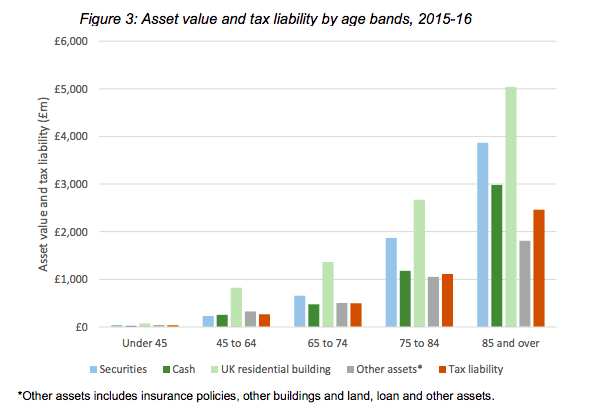

Just over 24000 families paid. Inheritance tax changes 2021 uk Friday May 13 2022 Edit. Estate Trust Tax Services.

Proposed changes to Capital Gains Tax. Inheritance Tax or IHT is a complicated topic with many different factors clauses and conditions to bear in mind. Apr 30 2021 30 Apr 20211.

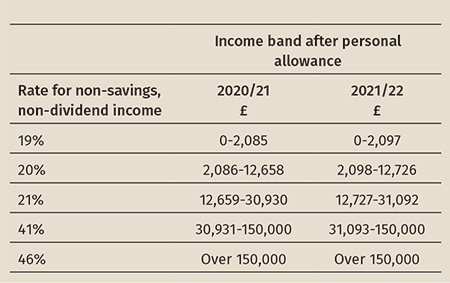

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. Chartered Legal Executive Kat King discusses the changes that will take affect from 1 st January 2022. The changes in tax rates could be as follows.

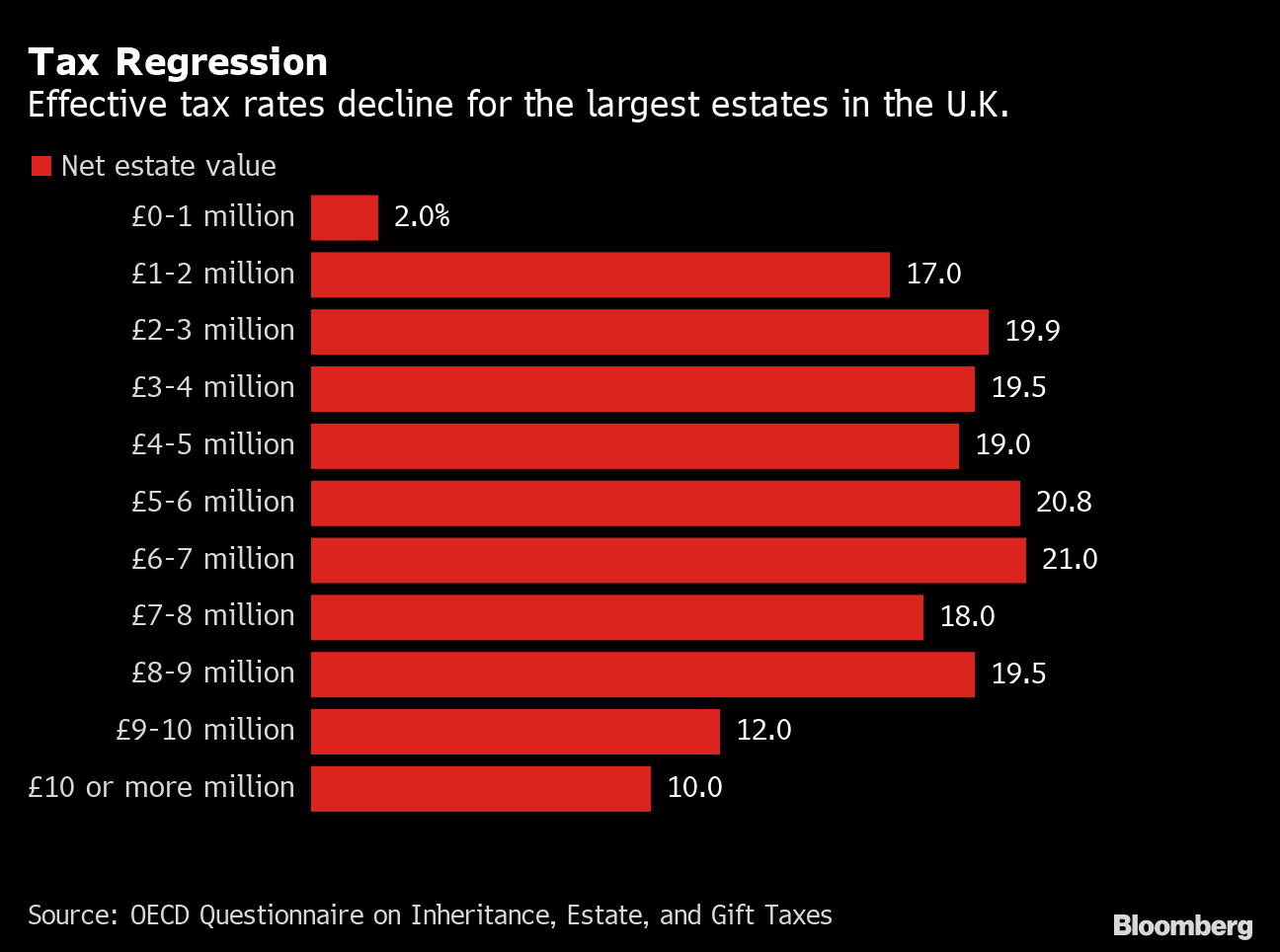

Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. The key points from this years publication are. A 10 charge to tax.

Inheritance tax bills are set to rise will you be caught out. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. UK Inheritance Tax Rules The FAQs.

In addition the residence nil-rate. Tell HMRC about houses. This is called entrepreneurs relief.

In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. However what is charged will be less if.

This could result in a significant increase in CGT rates if this recommendation is implemented. Often referred to colloquially as death tax it is a levy that is placed. Learn How EY Can Help.

Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the. In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April. Roughly 4 of deaths in the UK result in an inheritance tax bill.

Tax rates and allowances. Estate Trust Tax Services. Jointly owned assets IHT404 19 April 2016.

Jointly owned assets IHT404 19 April 2016. We previously published an article regarding the potential changes to the Inheritance Tax Rate and also Capital Gains Tax UK rate in 2021. This will be announced in the March.

Capital Gains Tax Rate UK 2021. The RNRB has increased from 100000 for the tax year 2017 to 2018 to 175000 for the tax year 2020 to 2021. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the.

Inheritance Tax Planning October 2022 Uk Guide

Changes To The Inheritance Tax Reporting Rules Icaew

The Future Of Uk Inheritance Tax Lessons From Other Countries Financial Times

Will King Charles Have To Pay Inheritance Tax On The Queen S Private Estate Valued At Over 750 Million As Usa

Inheriting From The United States While Living Abroad

Inheritance Tax Rules On Gifts To Loved Ones Should Be Simplified Bbc News

Inheritance Tax And Trusts Hmrc Registration Rules Change What Does This Mean For You Personal Finance Finance Express Co Uk

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

Inheritance Tax Changes Bills Are Set To Rise Moneyweek

Estate Tax In The United States Wikipedia

3 Potential Tax Changes For 2021 To Combat Coronavirus Borrowing And What They Might Mean For You The Pension Planner

Inheritance Tax Poised For A Comeback In The Post Covid Era Bloomberg

King Charles Won T Pay Inheritance Taxes On Queen S Estate 12news Com

Inheritance Tax Here S Who Pays And In Which States Bankrate

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Tax Day Inheritance Tax Changes Mercer Hole

Inheritance Tax Receipts Uk 2022 Statista

How To Avoid Inheritance Tax In The Uk 7 Legal Loopholes To Cut The Cost